Introduction

In recent years, South Africa has witnessed a significant transformation in its banking and financial technology (FinTech) landscape. Traditional banking systems are evolving rapidly to keep pace with technological advancements and changing consumer demands. Concurrently, FinTech companies are disrupting the conventional financial industry, offering innovative solutions and enhancing financial services.

Infographics by GO-Globe South Africa

The Evolution of Banking and FinTech in South Africa

The banking sector in South Africa has a rich history, marked by milestones that have shaped its current state. From the establishment of the first bank in the 19th century to the present digital era, the sector has continuously adapted to meet the needs of a growing and diverse population. In recent years, FinTech has emerged as a dynamic force in the South African financial landscape. These technological disruptors are offering alternatives to traditional banking, utilizing digital platforms to provide seamless and convenient financial services to consumers.

Read More on South Africa's Start-ups: Rise Of Start-Ups In South Africa

Government Regulations and Impact on FinTech

Government regulations play a pivotal role in shaping the trajectory of FinTech in South Africa. Regulatory frameworks are designed to ensure consumer protection, promote healthy competition, and foster innovation while maintaining financial stability. South Africa has been proactive in formulating a regulatory environment that fosters innovation while ensuring a level playing field. Regulatory bodies, such as the South African Reserve Bank (SARB) and the Financial Sector Conduct Authority (FSCA), work to oversee and regulate the financial sector, including FinTech. Government regulations significantly impact the operation and growth of FinTech in South Africa. Here are some key areas of influence:

Consumer Protection

Regulations aim to protect consumers from potential risks associated with FinTech services. This includes ensuring fair practices, transparent fees, and dispute resolution mechanisms.

Licensing and Compliance

FinTech companies must comply with licensing requirements set by regulatory bodies. Compliance ensures that these companies meet specific standards and guidelines, promoting a trustworthy and secure financial ecosystem.

Data Privacy and Security

With the rise of cyber threats, regulations mandate robust data privacy and security measures. FinTech entities are required to handle customer data responsibly and implement safeguards against data breaches.

Risk Management

Regulations necessitate risk assessment and management practices to ensure the stability and resilience of FinTech operations. This includes measures to mitigate financial, operational, and cybersecurity risks.

Innovation Encouragement

Despite regulations, there's an emphasis on encouraging innovation within the FinTech sector. Regulatory bodies collaborate with industry stakeholders to understand and support innovative solutions while maintaining compliance with established rules.

Financial Inclusion and Innovation in Digital Payments and Transactions

Financial inclusion, a crucial socio-economic goal, involves ensuring that individuals and businesses have access to affordable and suitable financial products and services. In South Africa, FinTech has emerged as a key player in advancing financial inclusion by leveraging innovative technologies to bridge gaps in accessibility and inclusivity.

Accessibility to Financial Services

FinTech has brought banking services to the fingertips of millions through mobile applications. People in remote areas or those lacking traditional banking infrastructure can now access banking and financial services on their smartphones.

Affordable Services

The cost-effectiveness of FinTech solutions enables financial institutions to offer services at lower costs, making it accessible to a broader spectrum of the population, including those in lower-income brackets.

Tailored Products for Underserved Communities

FinTech companies are designing products to cater to the specific needs of underserved communities. These offerings include microloans, micro-insurance, and savings plans tailored to the financial capacity and requirements of the target audience.

Digital Payments and Transactions

FinTech has revolutionized payment systems, providing a platform for seamless and secure digital transactions. This shift from cash to digital payments facilitates financial transactions for people who previously had limited access to banking services.

Financial Literacy

FinTech applications often come with educational resources and tools, enhancing financial literacy among users. Educated consumers are better equipped to make informed financial decisions, thereby contributing to their financial inclusion.

Cybersecurity Concerns in FinTech

With the increasing reliance on digital platforms, cybersecurity has become a paramount concern. Financial institutions and FinTech companies are investing heavily in cybersecurity measures to protect customer data and ensure secure transactions.

Sophisticated Cyber Threats

With the advancement of technology, cyber threats are becoming more sophisticated, targeting vulnerabilities in both traditional banking systems and emerging FinTech platforms.

Data Breaches and Privacy Violations

The increasing instances of data breaches and privacy violations have highlighted the need for stringent measures to protect sensitive customer data from falling into the wrong hands.

Financial Fraud and Identity Theft

Cybercriminals often engage in financial fraud and identity theft, posing a significant risk to individuals and businesses. They exploit weaknesses in cybersecurity systems to gain unauthorized access and steal valuable information.

Disruption of Services

Cyber-attacks can disrupt banking and financial services, causing inconvenience to customers and potentially resulting in financial losses for both institutions and clients.

Role of Big Data and AI in South African Banking and FinTech Sectors

Big Data and artificial intelligence (AI) are reshaping the way financial institutions operate. The banking and FinTech sectors are exploring AI-powered threat detection systems that can proactively identify potential threats and vulnerabilities, enabling a timely response to mitigate risks. These technologies enable data-driven decision-making, risk assessment, and personalized financial services, ultimately enhancing efficiency and customer experiences.

Customer Insights and Personalization

By analyzing vast amounts of data, banks and FinTech companies can gain valuable insights into customer behaviour and preferences. This knowledge enables the customization of services, offers, and recommendations, creating a more personalized and satisfying customer experience.

Risk Management and Fraud Prevention

Big Data analytics aids in identifying unusual patterns that may indicate fraudulent activities. It provides a proactive approach to risk management by flagging potential risks and enabling rapid responses to mitigate them.

Operational Efficiency and Automated Customer Service

Utilizing Big Data analytics, financial institutions can streamline their operations and processes. This includes optimizing resource allocation, reducing operational costs, and improving overall efficiency. AI-powered chatbots and virtual assistants are being deployed to handle customer inquiries and provide assistance, improving response times and ensuring 24/7 availability.

Credit Scoring, Fraud Detection and Prevention

AI algorithms assess creditworthiness by analyzing a multitude of data points, making loan approvals faster, more accurate, and fairer.

AI algorithms can swiftly detect unusual activities and potential fraud, enhancing security and reducing financial losses.

Enhanced Risk Assessment and Predictive Analytics

Combining Big Data analytics with AI enables a more comprehensive risk assessment, improving the accuracy of identifying potential risks and making better-informed decisions. Big Data and AI work hand-in-hand to predict market trends, customer demands, and investment opportunities. This foresight is invaluable in planning strategies and optimizing financial products and services.

Investment Trends in Banking and FinTech Start-Ups

Investment in South African FinTech companies is on the rise. Both local and international investors recognize the potential of the South African market and are funding innovative FinTech startups, fueling growth and development in the sector.

Increased Funding

The FinTech sector in South Africa is experiencing a surge in funding. Investors, both local and international, are recognising the potential of innovative FinTech start-ups and are injecting substantial capital to fuel their growth and development.

Venture Capital Involvement

Venture capital firms are actively participating in funding rounds, providing much-needed support to early-stage FinTech start-ups. This investment helps these start-ups scale their operations and introduce new, disruptive financial solutions.

Government Initiatives

The South African government is also contributing to the investment trends in FinTech by launching initiatives that support and fund innovative technology-driven financial solutions. These initiatives are encouraging the growth of the FinTech ecosystem.

Sustainable Finance and Its Growing Importance

Sustainable finance is critical in addressing global challenges like climate change, inequality, and poverty. By directing funds towards sustainable projects, the financial sector contributes to finding long-term solutions to these issues. Banks and FinTech companies are aligning their strategies with environmental, social, and governance (ESG) principles, contributing to a more sustainable future. Furthermore, investors are increasingly looking for ethical and sustainable investment opportunities. Financial institutions that prioritize sustainable finance are more likely to attract investment and retain a loyal customer base.

Regulatory Support

South Africa has a supportive regulatory environment for sustainable finance. Regulatory bodies encourage financial institutions to integrate sustainability into their operations through guidelines and incentives.

Major Initiatives

Many South African banks and FinTech companies have launched sustainable finance initiatives. These initiatives promote investments in renewable energy, support for small and medium-sized enterprises (SMEs), and sustainable agriculture.

Community Development

Sustainable finance in South Africa often focuses on community development. Investments in education, healthcare, and infrastructure projects are vital components, contributing to the overall socio-economic development of the nation.

Enhancing Reputation and Brand Value

Embracing sustainable finance helps financial institutions build a positive reputation in the market. Customers are more likely to trust and engage with organizations that demonstrate a commitment to sustainable practices.

Collaboration Between Banks and FinTech Start-Ups

Strategic Partnerships

Traditional banks are forming strategic partnerships with FinTech start-ups to leverage their innovative solutions. Banks bring their extensive customer base and resources to the table, while FinTech start-ups contribute technological innovation.

Joint Product Development

Collaboration often involves joint product development, where banks and FinTech start-ups collaborate to create new financial products or enhance existing ones. This synergy brings together traditional financial expertise and cutting-edge technology.

Accelerator Programs

Banks are initiating accelerator programs to nurture FinTech start-ups. These programs provide mentorship, resources, and funding to help FinTech companies grow and develop solutions that align with the banking sector's needs.

Banking and FinTech in South Africa: Facts, Figures and Latest Statistics

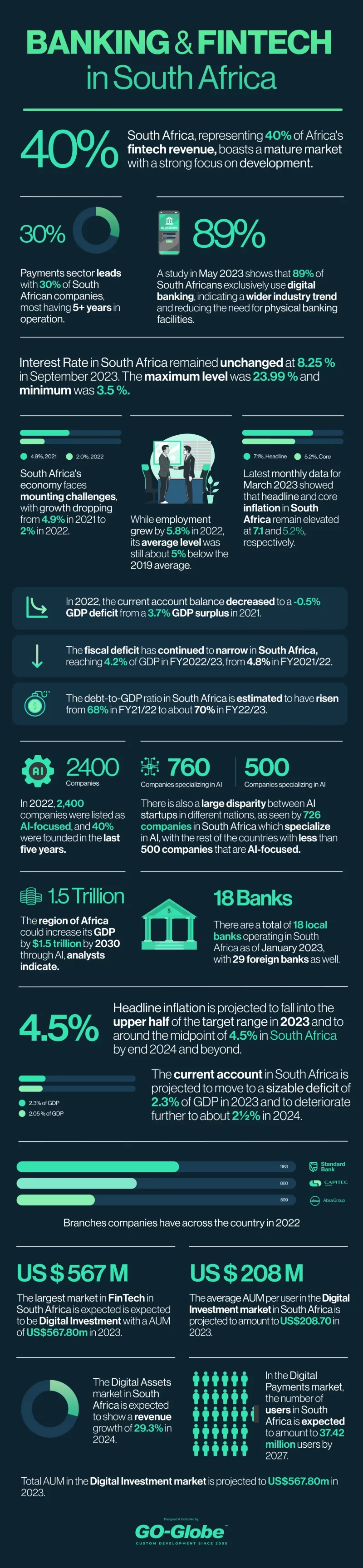

- Accounting for 40% of all fintech revenue in Africa, South Africa has a relatively mature fintech market with a strong focus on development.

- The largest and most mature subsector is payments, with 30% of companies in South Africa operating in this space, most of them for more than five years.

- A study in May 2023 shows that 89% of South Africans exclusively use digital banking, indicating a wider industry trend and reducing the need for physical banking facilities.

- Interest Rate in South Africa remained unchanged at 8.25 % in September 2023. The maximum level was 23.99 % and minimum was 3.5 %.

- South Africa’s economy is facing mounting economic and social challenges. Growth moderated from 4.9% in 2021 to 2% in 2022.

- While employment grew by 5.8% in 2022, its average level was still about 5% below the 2019 average.

- Latest monthly data for March 2023 showed that headline and core inflation in South Africa remain elevated at 7.1 and 5.2%, respectively.

- In 2022, the current account balance decreased to a -0.5% GDP deficit from a 3.7% GDP surplus in 2021.

- The fiscal deficit has continued to narrow in South Africa, reaching 4.2% of GDP in FY2022/23, from 4.8% in FY2021/22.

- The debt-to-GDP ratio in South Africa is estimated to have risen from 68% in FY21/22 to about 70% in FY22/23.

- In 2022, 2,400 companies were listed as AI-focused, and 40% were founded in the last five years.

- There is also a large disparity between AI startups in different nations, as seen by 726 companies in South Africa which specialize in AI, with the rest of the countries with less than 500 companies that are AI-focused.

- The region of Africa could increase its GDP by $1.5 trillion by 2030 through AI, analysts indicate.

- There are a total of 18 local banks operating in South Africa as of January 2023, with 29 foreign banks as well.

- Headline inflation is projected to fall into the upper half of the target range in 2023 and to around the midpoint of 4.5% in South Africa by end 2024 and beyond.

- The current account in South Africa is projected to move to a sizable deficit of 2.3% of GDP in 2023 and to deteriorate further to about 2½% in 2024.

- Despite the declining fiscal deficit, debt in South Africa is projected to increase from 71.4% of GDP in FY22/23 to 73.6% of GDP in FY25/26

- As of December 2022, Standard Bank Group reported having a total of 1,163 branches across the countries they operated in. Moreover, Capitec bank disclosed having 860 branches in South Africa by February 2023, while Absa Group had 559 as of June 2022.

- The largest market in FinTech in South Africa is expected is expected to be Digital Investment with a AUM of US$567.80m in 2023.

- The average AUM per user in the Digital Investment market in South Africa is projected to amount to US$208.70 in 2023.

- The Digital Assets market in South Africa is expected to show a revenue growth of 29.3% in 2024.

- In the Digital Payments market, the number of users in South Africa is expected to amount to 37.42 million users by 2027.

- Total AUM in the Digital Investment market is projected to US$567.80m in 2023.

Challenges and Opportunities for the Banking and FinTech Sectors

As the banking and FinTech sectors in South Africa continue to evolve, they encounter various challenges and opportunities. Addressing these challenges and harnessing the potential opportunities will define the future of finance in the nation. Looking ahead, the regulatory landscape is likely to continue evolving to keep up with the dynamic FinTech industry. However, challenges such as striking the right balance between innovation and regulation, adapting to technological advancements, and international alignment of regulations persist. Furthermore, addressing the digital divide and enhancing technological literacy among the population, especially in rural areas, is crucial to ensure that Banking and FinTech solutions reach the intended beneficiaries.

Future Outlook

The future of banking and FinTech in South Africa appears promising. Technological advancements, coupled with a supportive regulatory environment, are expected to drive further growth and innovation in the sector. The integration of FinTech into financial inclusion, and innovation in digital payments and transactions will allow technology to evolve and adapt to the needs of a diverse population, Banking and FinTech solutions will play an increasingly vital role in enhancing financial inclusion across South Africa. Furthermore, utilizing Big Data can allow financial institutions to better comply with regulatory requirements by efficiently managing and analyzing the vast amount of data needed for compliance.

Conclusion

The intersection of banking and FinTech in South Africa is at an exciting juncture. The continuous evolution of technology and the willingness of the financial industry to adapt are shaping a promising future, where convenience, innovation, and financial inclusion will be at the forefront. Government regulations and Financial Inclusions have a profound impact on the growth and direction of FinTech in South Africa. Striking a delicate balance between fostering innovation and ensuring consumer protection is critical for the sustainable growth of the FinTech sector.

Frequently Asked Questions (FAQs)

Q1: How is FinTech impacting traditional banking in South Africa?

A: FinTech is challenging traditional banking by offering innovative digital solutions, streamlining processes, and providing convenient alternatives for consumers.

Q2: Are there any concerns about data privacy in the FinTech sector?

A: Yes, data privacy is a significant concern in FinTech. Companies are implementing robust security measures to protect customer data and ensure privacy.

Q3: How is the South African government supporting FinTech growth?

A: The South African government is fostering FinTech growth through regulatory support, innovation hubs, and initiatives aimed at promoting financial technology.

Q4: What are the key trends shaping the South African FinTech market in 2023?

A: Key trends include increased adoption of digital payments, AI integration, sustainable finance, and partnerships between traditional banks and FinTech startups.

Q5: What are the key challenges for South Africa in balancing innovation and regulation in FinTech?

A: Balancing innovation and regulation poses challenges in terms of adapting to technology, aligning regulations with international standards, and finding the right equilibrium for sustainable growth.

Q6: What challenges does South Africa face in integrating FinTech for financial inclusion?

A: Challenges include addressing technological literacy, building trust in digital services, and establishing a supportive regulatory framework that balances innovation and consumer protection.

Q7: How can customers protect themselves from cyber threats while using banking and FinTech services?

A: Customers can protect themselves by following safe online banking practices, regularly updating passwords, being cautious of phishing attempts, and reporting any suspicious activities.

Q8: How does AI benefit customer service in the South African banking sector?

A: AI enhances customer service by providing automated assistance through chatbots and virtual assistants, ensuring faster response times and availability around the clock.

Q9: Can you elaborate on the innovation and agility gained through collaboration between banks and FinTech start-ups?

A: Collaboration enables banks to integrate cutting-edge technologies offered by FinTech start-ups, fostering innovation and agility in their approach to financial services.

Tags:

Gulf News