Introduction and Historical Significance

Bahrain's strategic location, well-established financial regulations, and commitment to innovation have contributed to its emergence as a notable player in the global financial landscape. The integration of traditional banking practices with cutting-edge FinTech solutions has propelled the country's financial sector to new heights.

Bahrain's financial sector boasts a rich history dating back centuries. It was one of the first Gulf Cooperation Council (GCC) countries to adopt modern banking systems, which laid the foundation for its current status as a regional financial powerhouse.

Traditional Banking Landscape in Bahrain

Traditional banks in Bahrain have played a pivotal role in shaping the economy. With a robust network of domestic and international banks, Bahrain offers an array of financial services catering to individuals, businesses, and investors.

Some of the information related to banks include:

- There are both conventional and Islamic banks in Bahrain.

- Some of the major banks in Bahrain include Ahli United Bank, Bank of Bahrain and Kuwait, and National Bank of Bahrain.

- The Bahrain Association of Banks is the main industry body representing banks in the country.

- The Central Bank of Bahrain regulates banks in the country and has implemented a number of initiatives to promote innovation in the sector.

The Advent of FinTech in Bahrain

The FinTech revolution in Bahrain has redefined the way financial services are accessed and delivered. Startups and established companies are leveraging technology to enhance efficiency, reduce costs, and democratize financial services.

There are a number of FinTech's based in Bahrain, including:

- Rain, a cryptocurrency exchange

- Skiplino, a queue management platform

- Tarabut Gateway, an open banking platform

- Eazy Financial Services, a digital payments provider

Bahrain's Regulatory Framework for FinTech

Bahrain's Central Bank has embraced FinTech by introducing progressive regulations that encourage innovation while ensuring consumer protection and financial stability. This proactive approach has attracted numerous FinTech firms to establish operations in Bahrain.

Here are some of the advancements and solutions for the Financial Sector:

Collaboration between Banks and FinTech Firms

Rather than perceiving each other as competitors, traditional banks and FinTech firms in Bahrain have recognized the value of collaboration. Partnerships have led to the development of hybrid solutions that combine the strengths of both sectors.

The Central Bank of Bahrain has implemented a number of initiatives to promote innovation in the financial sector, including:

- The Regulatory Sandbox, which allows fintechs to test their products and services in a controlled environment before launching them to the public.

- The Fintech Unit, which was established to support the growth of the fintech industry in Bahrain.

- The Electronic Fund Transfer System, which enables real-time payments and transfers between banks.

- The Open Banking Framework, which allows customers to share their financial data securely with third-party providers.

Mobile Banking Revolution

The widespread adoption of smartphones has driven the mobile banking revolution in Bahrain. Customers now have seamless access to a wide range of financial services at their fingertips, from checking account balances to making investments.

Digital Payment Solutions

Innovative digital payment solutions have gained significant traction in Bahrain. Mobile wallets, QR code payments, and contactless transactions have transformed the way people conduct their day-to-day financial activities.

Blockchain and Cryptocurrency in Bahrain

Bahrain has shown a keen interest in exploring the potential of blockchain technology and cryptocurrencies. The government's open-minded approach has attracted blockchain startups and encouraged discussions on regulatory frameworks for digital assets.

Lending and Borrowing Innovations

FinTech has introduced novel lending and borrowing platforms that utilize data analytics and alternative credit scoring methods. This has improved access to credit for individuals and businesses that were previously underserved by traditional banks.

Enhanced Customer Experience through Technology

Technology has empowered financial institutions to offer personalized and seamless customer experiences. Chatbots, AI-driven advisory services, and user-friendly apps are just some of the ways Bahrain's financial sector is enhancing customer satisfaction.

Bahrain's Banking and FinTech Innovation: Trends and Latest Statistics

Infographics by GO-Globe Bahrain

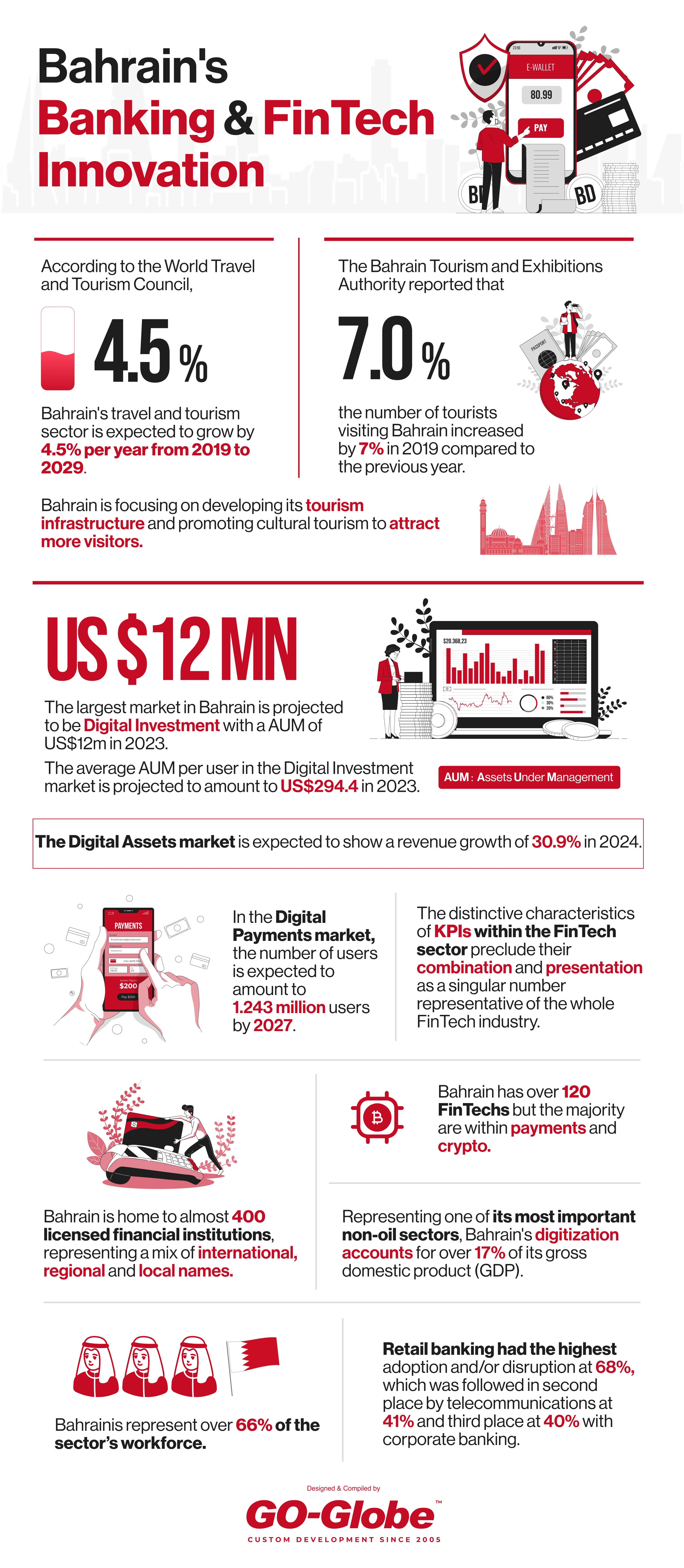

- According to the World Travel and Tourism Council, Bahrain's travel and tourism sector is expected to grow by 4.5% per year from 2019 to 2029.

- The Bahrain Tourism and Exhibitions Authority reported that the number of tourists visiting Bahrain increased by 7% in 2019 compared to the previous year.

- Bahrain is focusing on developing its tourism infrastructure and promoting cultural tourism to attract more visitors.

- The largest market in Bahrain is projected to be Digital Investment with a AUM of US$12m in 2023.

- The average AUM per user in the Digital Investment market is projected to amount to US$294.4 in 2023.

- The Digital Assets market is expected to show a revenue growth of 30.9% in 2024.

- In the Digital Payments market, the number of users is expected to amount to 1,243.00k users by 2027.

- The distinctive characteristics of KPIs within the FinTech sector preclude their combination and presentation as a singular number representative of the whole FinTech industry.

- Bahrain has over 120 fintechs but the majority are within payments and crypto.

- Bahrain is home to almost 400 licensed financial institutions, representing a mix of international, regional and local names.

- Representing one of its most important non-oil sectors, Bahrain's digitization accounts for over 17% of its gross domestic product (GDP).

- Bahrainis represent over 66% of the sector’s workforce.

- Retail banking had the highest adoption and/or disruption at 68%, which was followed in second place by telecommunications at 41% and third place at 40% with corporate banking.

Challenges and Future Growth Opportunities

While Bahrain's financial sector has made remarkable strides, challenges such as regulatory fine-tuning, talent acquisition, and market competition persist. These challenges, however, present opportunities for further growth and innovation. The country's financial sector is poised for exponential growth. The convergence of traditional banking expertise and disruptive FinTech solutions positions the country as a regional and global leader in the financial technology landscape.

Conclusion

Bahrain's Financial Sector's journey from traditional banking practices to embracing FinTech innovation exemplifies the nation's commitment to progress and innovation. With a conducive regulatory environment, collaborative spirit, and a customer-centric approach, Bahrain's financial sector stands on the cusp of an exciting future.

Frequently Asked Questions (FAQs)

Q1: How did Bahrain become a financial hub in the Middle East?

A: Bahrain's early adoption of modern banking systems and strategic location contributed to its rise as a financial hub.

Q2: What is the role of traditional banks in Bahrain's financial ecosystem?

A: Traditional banks in Bahrain play a crucial role in providing a wide range of financial services to individuals and businesses.

Q3: How has FinTech transformed Bahrain's financial landscape?

A: FinTech has introduced innovative solutions that enhance efficiency, accessibility, and customer experience in financial services.

Q4: What is the Bahraini government's stance on cryptocurrencies?

A: Bahrain has adopted an open-minded approach, exploring the potential of blockchain and discussing regulatory frameworks for cryptocurrencies.

Q5: What challenges does Bahrain's financial sector face?

A: Challenges such as regulatory adjustments, talent acquisition, and market competition are among the factors shaping Bahrain's financial sector's future.

Tags:

Gulf News